Conventional wisdom says extensive expense reporting is only applicable to large businesses. However, recent surveys reveal small businesses can also benefit from streamlining their expense reporting tools as well.

According to Certify, a cloud-based expense management software solutions provider, companies now spend as much as 10-12% of their total annual revenues on travel and entertainment.

As a small business, keeping track of your daily expenses can be a complicated process, but it’s imperative nonetheless. By tracking every dollar spent on your employees, small businesses can streamline their budget and improve their profit margins.

Even though it sounds pretty straightforward, many businesses actually fail to keep track of their daily expenses and, as a result, miss the boat on growth.

How Do Companies across the Country Manage Their Expenses?

A survey of 500 CFOs conducted by Certify offers deep insights into how companies across the country fare when it comes reporting their expenses.

Entitled “Certify Annual Expense Management Trends”, the survey presents useful insights from leading finance professionals in the country.

Expenses Management Process

50% of the companies surveyed said they were managing travel and entertainment (T&E) expense reporting manually, meaning they were using spreadsheets, pen and paper, or home-grown systems to maintain their day-to-day expense reports.

On the other hand, 35% of respondents said they were using web-based expense management tools while 15% of those surveyed revealed they were using an ERP software for their expense management process. Managing travel expenses and reports has never been easier with Bento’s travel reimbursement software.

Expenses Management Challenges

Regardless of their approach to reporting expenses, companies still face many challenges in the process. Among the most common challenges encountered by companies, missing paper receipts topped the list with as many as 50% the respondents saying it was one of their major pain points while tracking expenses.

Likewise, 45% of the participants attributed it to the failure of their employees to submit reports on time.

With 38%, time constraints for reconciliation, review, and approval of reports were considered the third most pressing issue, while reviewing of policy violations, and errors on expense reports accounted for 30% and 28% of all challenges respectively.

Expense Report Processing Costs

Processing expense reports is not only complicated, it’s expensive as well. The survey found that the average processing cost using a manual system was $26.63 per expense report while it was only $6.85 per report for companies using a fully automated system. Interestingly, 48% of companies surveyed said they didn’t track the processing costs at all.

Employee Reimbursement Times

Employee reimbursement plays a key role in the overall satisfaction index of your workforce. After all, a happy employee is a productive employee.

Of all the companies surveyed, 63% said they reimbursed their employees within 7 days while 35% said they required 8 to 30 days for employee reimbursement.

Expense Category Spending Limits

Since employee expenses take a sizable portion in company’s annual revenues, many business organizations set a maximum limit on what their employees can spend on.

The annual T&E outlook and benchmarks survey found that 25% of the companies set no limits on any expense categories whatsoever, while an equal number of companies determine the limits based on historical spending patterns of their employees.

Likewise, 24% of companies surveyed said they were following US GSA per Diem guidelines and 20% said their annual budgets determined the maximum spending limits on meals, hotels, and airfare.

Benefits of Automation

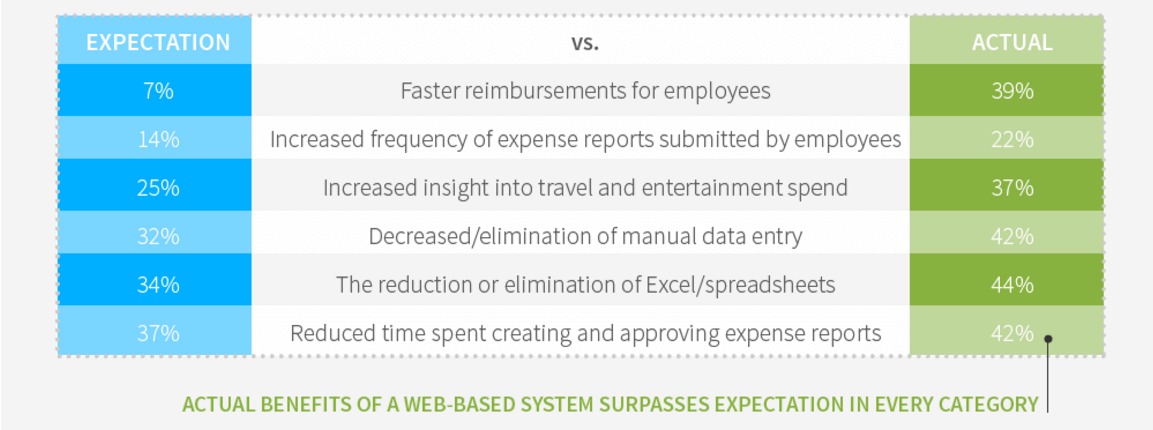

The survey found that companies using automation, i.e. a web-based system, saw huge advantages of the move. Interestingly, the actual experience of using the software surpassed their expectations prior to switching to automation in almost all categories.

The categories included reimbursement to employees, frequency of expense report submission, insight into T&E spending, time spent on manual data entry, use of spreadsheets and approval of expense reports submitted.

Return on Investment

With increased benefits from automation used by the companies surveyed, many said they saw a decent growth in the Return on Investment (ROI) as well.

The biggest benefit of switching to automation, as reported in the survey, was the improvement in efficiency and reporting process which had the highest contribution (58%) to the ROI.

Similarly, reduction in the report processing costs in terms of paper, postage and storage also accounted for (53%) the increased ROI.

Among other benefits were mobile accessibility (33%), increased employee productivity (26%), reduction in staffing requirements (22%), elimination of payment for duplication expenses (22%), travel booking control (21%), reduction in fraudulent expenses (16%), and more accurate mileage tracking (15%).

Final Thoughts

If you’re a small business, tracking employee expenses can hamper your productivity in more ways than you can imagine. Things like missing paper receipts, duplicate entries, reimbursements and fraudulent behaviors can shore up your company’s expenses, affecting revenues.

Designed to help businesses ward off the potential bottlenecks of tracking expense manually, the Bento App can help you track your employee expenses and streamline reporting. Sign up for Bento today.

—–

Sources:

https://www.certify.com/2015-12-10-2016-Expense-Management-Trends–Annual-TE-Outlook-and-Benchmarks

About Bento for Business

Bento for Business offers a new generation of technology-driven SMART employee expense cards for SMBs, nonprofits, organizations and associations in the form of a business prepaid MasterCard. You can set monthly spend limits and allow only certain purchase categories (e.g. Bob the project manager can only spend $500/week and the card only works to purchase gas, hotels and at the hardware store). Turn cards on/off in real-time and receive SMS text message or email alerts for every purchase or decline. Enjoy unmatched visibility into cash flow, eliminate expense reports, and save time & money. Use this link to learn more and start your FREE 60-day trial of Bento’s business prepaid cards.