Business Spend Management Simplified

Say goodbye to reimbursing employees, cutting checks, reconciling receipts, and managing petty cash.

Say hello to our intuitive card-based business spend management platform and its industry-leading Controls and Reconciliation Tools.

Save Money, Time, and Effort!

By preventing unauthorized transactions outside of their chosen spend policy

Explore Bento's Award Winning Platform

How can Bento help you?

Bento is an intuitive, debit card based business spend management platform that helps customers:

Save Money

Bento helps you track and prevent unnecessary spending by:

- Setting daily spend limits

- Restricting merchant categories

- Restricting international transactions

- Turning cards on/off if lost or misplaced

Our average customer reduces spending by over 15% by switching from traditional business cards and cash to Bento’s accounting platform, corporate cards and virtual cards.

Save Time

Manage business spending by eliminating time-consuming processes:

- No more approval workflows

- Set up customized controls unique to each card

- Reduce time spent on creating and tracking expense reports

- Proactively track transactions in real-time

With these processes out of the way, you and your employees have more time to do the work that matters without having to worry about spending management.

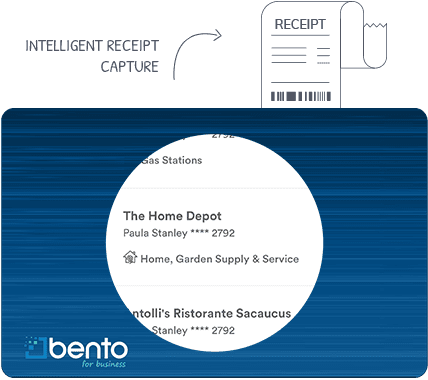

Save Effort

Bento offers AI-based receipt capture and efficient reporting tools that let you:

- Store expense reports and receipts in one place

- Automate expense reporting

- Export data into QuickBooks or any other accounting platforms

- Travel Reimbursement Software

These tools ensure that you and your employees won’t be tied up with administrative work and it makes closing your books a breeze too.

Questions Have

Is Bento a credit card?

No, Bento is not a credit card. Bento offers full-featured VISA debit cards that allow you to manage the cash you already have more efficiently and ensure that you have real time visibility and control over your cash flow. All the security of debit cards with the utility and benefits that cannot be matched by even the best credit cards in the market.

I already use a business credit card; how is Bento better?

Typical business credit cards don’t offer many admin and control features and are limited to reporting that is more suited for consumers than businesses. Bento was built from the ground up to specifically address the needs and challenges of businesses. Our proprietary controls and tools save our customers over 15% on average when they switch from other ’typical’ business credit cards.

What about rewards or cashbacks?

Why restrict yourself to a limited amount of cash back or reward points, when you can save seamlessly. Bento’s card controls helped customers save $85,568,454 to date and still counting. Learn more about how Bento Saves.

Is this a bank account?

Bento is not a traditional bank account but rather a modern spend management platform that makes it safer, easier, and faster to operate your business. To use Bento, you must transfer funds from your existing, verified savings or checking account to your Bento account. Rest assured that any funds deposited at Bento are FDIC insured to at least $250,000 through our partner, The Bancorp Bank, N.A., Member FDIC.

What do I need to apply?

As a part of our verification process here is the list of documents as required by our banking partners and in support of the USA PATRIOT Act*.

Taking advantage of these benefits is

easy. Bento for Business makes it simple to switch!

Quick sign-up and approval process with no credit pull or personal guarantees

Download and use the Bento mobile app to manage everything on the go

Import your employee roster and order cards for your whole team with just a couple of clicks

Ship cards to your main office or directly to employees' homes

Happy Customers Say it All

Our passion for excellence in service and product innovation shines through in our customer’s reviews of Bento. Read for

thousands of happy customers. Small business spending management has never been easier.

As Seen In: